A message from our

Director of Care

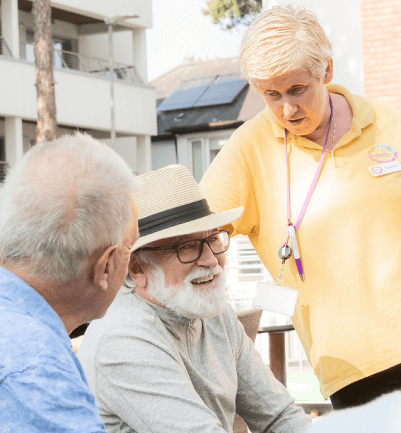

At Orwell Healthcare we strive to provide the best quality of care focused on older people and people with disabilities in a homely comfortable atmosphere. I started my own career journey with Orwell over 10 years ago and now as the Director of Care, I am proud to continue to develop excellence in care along with my team. We are committed to providing an environment where everyone’s voice matters, where residents, families and staff are understood, respected and supported. I firmly believe in ongoing training and professional development to continuously improve and advance our healthcare services.

Diana Rose